PT Kalimasada Nusantara Pratama

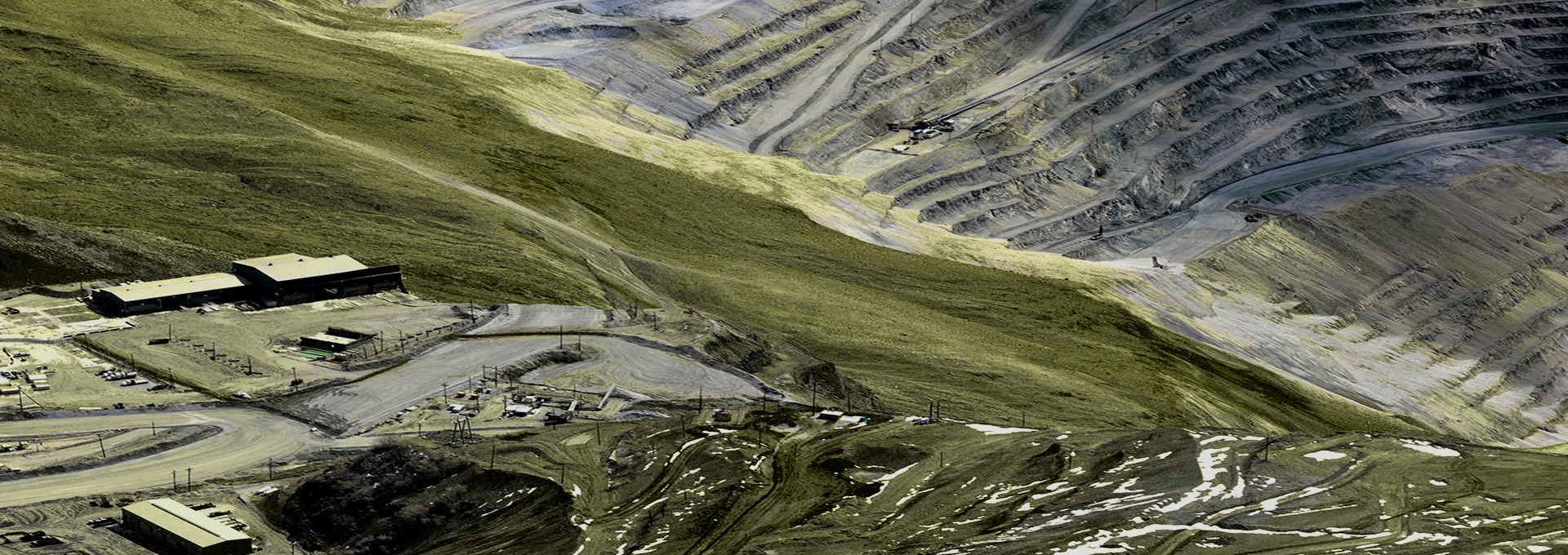

Mining & Metallurgy Consultant

A mining and metallurgy consultant is a professional who provides advice and services to the mining and metallurgy industries. They typically have a background in geology, mining engineering, or metallurgy, and they use their expertise to help companies with a variety of tasks, such as:

- Exploration : Identifying and evaluating potential mining projects.

- Mine planning : Designing and optimizing mining operations.

- Process engineering : Developing and implementing metallurgical processes to extract metals from ores.

- Environmental compliance : Ensuring that mining operations comply with environmental regulations.

- Safety management : Developing and implementing safety procedures to protect workers.

Mining and metallurgy consultants play an important role in the mining and metallurgy industries. They help to ensure that mining operations are safe, environmentally sound, and profitable.

Industrial & Resources Supply

The industrial and supply industry is a broad term that encompasses a wide range of businesses that provide products and services to industrial customers. These businesses can be classified into two main categories: distributors and manufacturers.

Distributors purchase products from manufacturers and sell them to industrial customers. They typically specialize in a particular product or service, such as safety supplies, electrical equipment, or plumbing supplies. Distributors often provide value-added services to their customers, such as inventory management, order processing, and delivery.

Gold and Metal Trading

Gold trading is the act of buying and selling gold. It can be done in a variety of ways, including through physical gold, gold futures contracts, and gold exchange-traded funds (ETFs).

Physical gold is the most common form of gold trading. It involves buying and selling actual gold bars, coins, or jewelry. Physical gold can be traded through a variety of channels, including bullion dealers, online exchanges, and pawn shops.

Gold futures contracts are a type of derivative contract that allows traders to buy or sell gold at a predetermined price in the future. Gold futures contracts are traded on exchanges, such as the Chicago Mercantile Exchange (CME).

Gold ETFs are a type of investment fund that tracks the price of gold. Gold ETFs are traded on exchanges, just like stocks and bonds.

Gold trading can be a profitable investment, but it is important to understand the risks involved. The price of gold can be volatile, and it is possible to lose money if the price of gold falls.